In business and finance, trust and assurance are foundational. Lenders, landlords, employers, and courts often require additional parties to back an agreement or verify information. When navigating the financial and legal landscape of business, you may encounter terms like guarantor, surety, and referee. While these roles often appear in contracts, loans, and legal proceedings, their meanings and implications are distinct yet sometimes confused.

Understanding these roles is crucial, particularly for young professionals just starting their careers, entrepreneurs seeking to expand their businesses, and anyone considering the responsibility of acting as a guarantor or surety for another person or entity. Gaining a clear comprehension of these roles can help individuals make informed decisions and avoid potential financial and legal pitfalls in the future.

This blog post aims to provide a clear and detailed explanation of what it truly means to act as a guarantor, surety, or referee within the context of business. It will thoroughly explore the various responsibilities and obligations that come with these roles, offering valuable insights into what is expected from individuals who take on such commitments.

Additionally, the post will emphasize the potential risks associated with these positions and present effective best practices designed to safeguard both your financial stability and legal rights in these situations.

Guarantor, Surety, or Referee

In the world of business, using precise and accurate language is incredibly important, particularly when dealing with financial obligations and legal responsibilities. Understanding the exact meaning of key terms can make a significant difference in how agreements are interpreted and enforced.

Let’s take a closer look at the basic definitions of a Guarantor, Surety, and Referee, and explore why it is essential to pay close attention to each of these terms to avoid misunderstandings and ensure clarity in your business dealings.

| Role | Definition | Primary Responsibility | Liability Scope | Common Use Cases |

|---|---|---|---|---|

| Guarantor | An individual or entity who promises to pay a debt if the borrower defaults. | Financial backup for loan repayment. | Can be limited or unlimited, depending on contract terms. | Loans, leases, mortgages, and business credit. |

| Surety | A person who guarantees the performance or obligations of another under a contract. | Ensures contractual duties are fulfilled. | Liable if the principal fails to perform. | Construction bonds, rental agreements, and loan guarantees. |

| Referee | A neutral third party appointed by a court to investigate and report on specific issues in a legal case. | Investigates and reports findings to assist court decisions. | No financial liability; role is advisory. | Legal disputes, complex financial or family law cases. |

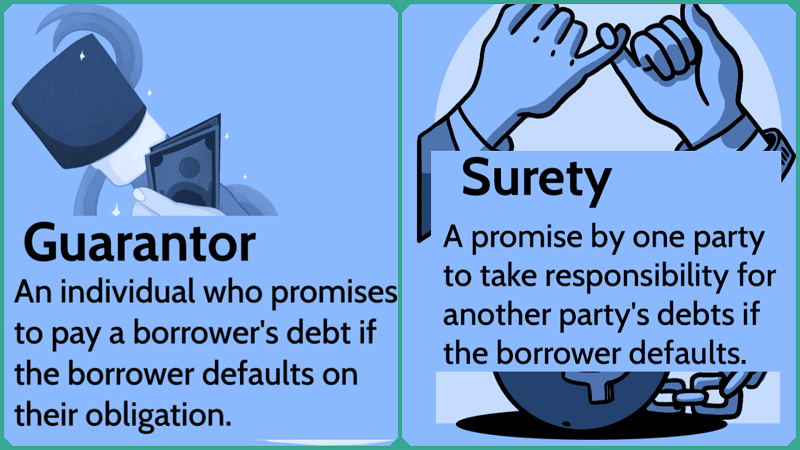

What Is a Guarantor?

A guarantor is an individual or entity who formally agrees to take full responsibility for another person’s debt or financial obligation if the original person fails to meet their repayment commitments or other required duties.

This important role is particularly common in various lending and leasing situations, especially when the primary borrower or tenant lacks a strong credit history or adequate financial standing to independently qualify for a loan, mortgage, or rental agreement.

The guarantor essentially provides additional security and assurance to the lender or landlord, helping to facilitate approval when the primary party’s financial credentials are insufficient.

Key Points About Guarantors

Financial Liability

If the borrower fails to fulfill their obligations and defaults on the loan or lease agreement, the guarantor then becomes legally responsible for repaying the entire outstanding debt. This includes not only the principal amount owed but also any accrued interest, late fees, and additional penalties that may have been incurred.

Essentially, the guarantor’s financial responsibility serves as a crucial safety net or backup for the lender or landlord, ensuring that they receive the owed payments even if the primary borrower cannot meet their commitments.

Collateral

In many cases, guarantors are required to pledge their assets as a form of security for the debt they are guaranteeing. This pledged collateral serves as a safeguard for the lender, as it can be seized, sold, or liquidated if the guarantor does not meet their repayment responsibilities.

Because of this possibility, the risk associated with serving as a guarantor is significantly heightened, making it a serious financial commitment that should be carefully considered.

Limited vs. Unlimited Liability

The extent of a guarantor’s liability can differ significantly depending on the terms agreed upon. Some guarantors choose to assume responsibility for only a portion of the total debt or agree to cover the debt for a specific, limited period of time, which is known as limited liability.

On the other hand, some guarantors may be held accountable for the full loan amount throughout the entire duration of the loan, which is referred to as unlimited liability. It is extremely important to carefully review and fully understand all the terms and conditions before signing any agreement to avoid unexpected financial obligations.

Credit Impact

Acting as a guarantor can have a significant effect on your credit score and your overall borrowing capacity. In cases where the borrower misses payments or defaults on the loan, these negative actions will be recorded on the guarantor’s credit report.

Such delinquencies can remain on your credit history, potentially making it much more difficult for you, as the guarantor, to secure new credit or loans in the future. This financial responsibility can therefore have long-lasting consequences on your ability to access credit.

Legal Risks

Lenders or landlords often have the right to pursue legal action directly against guarantors without the necessity of first attempting to collect payments from the original borrower. This legal approach means that guarantors can find themselves facing serious consequences such as lawsuits, wage garnishments, or even the seizure of personal assets if the primary party fails to meet their financial obligations or defaults on the agreement.

These risks highlight the significant responsibility and the considerable potential financial exposure that guarantors willingly assume when they agree to guarantee a loan or lease. This commitment involves a serious obligation that can have substantial monetary consequences if the primary borrower fails to meet their payment obligations.

Real-World Example

Imagine a small business owner who has a limited credit history and is applying for a business loan. In such cases, the bank may require a guarantor to back the loan as an extra layer of security. A trusted partner or a close family member with a stronger and more established credit profile might agree to act as the guarantor, assuring the lender that the loan will be repaid even if the business owner is unable to meet their repayment obligations.

While this kind of support can be crucial in helping the business owner secure the necessary funding to grow their business, it is important to understand that the guarantor takes on significant financial risk by agreeing to this arrangement.

Understanding the full scope of responsibilities and potential risks involved in being a guarantor is critical before agreeing to take on this important role. It is essential to carefully read and fully comprehend all the terms and conditions associated with the guarantee.

Additionally, you should thoughtfully consider your financial capacity to handle any obligations that might arise. Seeking professional legal advice if necessary is highly recommended to ensure your interests are thoroughly protected throughout the process.

Understanding Surety

The term surety is closely connected to the concept of a guarantor, yet it possesses broader and more precise applications within the realm of contract law. Unlike a guarantor, who mainly pledges to repay a debt if the borrower defaults, a surety guarantees the performance of a specific obligation or duty.

This important distinction makes suretyship especially significant in various industries, particularly in construction, where surety bonds play a crucial role in ensuring that projects are completed according to the agreed terms and conditions.

Key Aspects of Surety

Contractual Guarantee:

A surety commits to ensuring that the principal party, which refers to the individual or business entity responsible for carrying out the terms of the contract, successfully fulfills all their contractual obligations.

This commitment means the surety is actively involved in guaranteeing the actual completion and proper execution of the contract itself, rather than simply providing a guarantee for financial repayment or monetary compensation alone.

Liability

If the principal party fails to fulfill their contractual obligations—such as completing a construction project within the agreed-upon timeframe—the surety is required to step in and take responsibility. This intervention may involve compensating the affected party financially for any losses or damages incurred, or ensuring the completion of the obligation themselves.

The surety has the option to accomplish this either by taking direct control and managing the completion of the project themselves or by hiring another qualified and capable party to step in and fulfill the remaining outstanding duties on their behalf.

This approach ensures that the obligations are met efficiently and effectively, regardless of whether the surety chooses to handle the work personally or delegate it to a competent third party.

Historical Roots

Suretyship is a concept with a rich and ancient heritage, tracing back thousands of years to early civilizations where the need for trust and mutual assurance in commercial transactions was already recognized. This longstanding principle has evolved over centuries, adapting to various legal systems and economic practices.

Even in today’s complex global economy, suretyship continues to play a crucial role, particularly in industries that rely heavily on performance bonds, contractual guarantees, and financial security to ensure obligations are met and risks are managed effectively.

Examples:

- A construction contractor often secures a surety bond as a financial guarantee to ensure the timely, efficient, and satisfactory completion of a building project. This bond serves as a formal assurance that the contractor will fulfill all contractual obligations according to the agreed-upon schedule and quality standards.

- A landlord might often require a surety as an added form of security to ensure that tenants consistently pay their rent on time and take proper care of the property, maintaining it responsibly throughout their lease agreement.

- Businesses often utilize surety bonds as a reliable method to guarantee their compliance with various regulations or specific contractual terms. These bonds serve as a formal assurance that the business will fulfill its obligations as outlined by legal requirements or agreed-upon contracts, providing peace of mind to all parties involved.

Guarantor vs. Surety: The Crucial Difference

While the terms “guarantor” and “surety” are often used interchangeably in everyday language, the fundamental and most important difference between them lies in the specific nature and extent of their legal responsibility and obligation:

- A guarantor primarily assumes financial responsibility—this means they are legally obligated to pay the outstanding amount if the borrower fails to repay or defaults on a debt.

- A surety takes on direct responsibility for performance, meaning they provide a formal guarantee that the contractual obligations will be fully and faithfully carried out as agreed. They ensure the actual completion and fulfillment of all duties specified within the contract.

This important distinction means that sureties frequently take on a much more active and involved role in guaranteeing that obligations are properly fulfilled, which in turn makes their liability potentially broader in scope and more immediate.

Why Understanding Surety Matters

For entrepreneurs, small business owners, and professionals who are actively involved in managing contracts, having a thorough understanding of the implications of suretyship is absolutely essential. Agreeing to act as a surety can expose you to substantial financial and legal risks, especially if the principal party fails to fulfill their contractual obligations.

It is crucial to always carefully review any surety agreements you are presented with and to seek knowledgeable legal counsel. This will help you fully comprehend your responsibilities, potential liabilities, and the protections available to you before making any commitment to serve as a surety.

The Role of a Referee in Business and Legal Contexts

The role of a referee in business and legal settings is fundamentally different and distinctly separate from that of guarantors and sureties. Unlike guarantors and sureties, who assume financial or contractual liability, a referee serves as a neutral and impartial third party appointed either by courts or by the disputing parties themselves.

The primary responsibility of a referee is to thoroughly investigate specific issues or disputes presented to them and to provide an unbiased, well-considered report based on their findings. This role is incredibly important because it assists courts in understanding complex facts, technical details, or specialized matters, ultimately enabling judges to make more informed and fair decisions in legal cases.

Important Details About Referees

Neutral Investigator

Referees are entrusted with the important responsibility of gathering comprehensive evidence, carefully analyzing all relevant facts, and objectively evaluating the situation at hand. Their primary role is to deliver an impartial and unbiased report that helps clarify any disputed issues, ensuring that the findings are fair and transparent.

Unlike advocates, who often champion one side, they do not take sides or promote the interests of either party involved in the dispute or discussion. Instead, their primary focus is on presenting a clear, objective, and balanced assessment that is firmly based on the evidence collected.

They strive to maintain impartiality throughout the process, ensuring that their evaluation is fair and unbiased, reflecting only the facts and information at hand.

No Financial Liability:

Unlike guarantors or sureties, who take on financial obligations, referees do not assume any form of financial responsibility or risk whatsoever. Their role is strictly advisory and procedural, ensuring processes are followed without incurring any monetary liability or exposure.

Use Cases: Referees are most commonly appointed in a wide variety of cases involving different types of disputes and situations, including but not limited to:

- Construction disputes often arise in situations where specialized technical expertise is crucial to thoroughly assess and resolve complex project issues. These disputes typically involve detailed evaluations of construction methods, materials, design specifications, and compliance with industry standards, requiring experts to provide accurate analysis and informed opinions.

- Family law cases that require thorough and detailed financial investigations or extensive custodial evaluations. These cases often involve complex assessments of financial records, assets, income, and expenditures, as well as in-depth examinations of the living conditions, parenting capabilities, and overall well-being of the children involved. Such investigations are essential to ensure fair and just outcomes in matters related to divorce settlements, child support, custody arrangements, and visitation rights.

- Financial disagreements arise in situations where specialized accounting or valuation expertise is required for proper resolution and understanding.

- Any intricate and multifaceted legal matter in which the court finds it necessary to obtain a specialized expert assessment to effectively resolve complex factual disputes that are critical to the case.

Legal Authority:

The findings and detailed reports submitted by referees hold substantial and critical weight in various court proceedings. Judges frequently depend on these comprehensive reports as key pieces of evidence, which can play a decisive role in shaping rulings and final settlements during legal cases.

Why Referees Matter in Business and Legal Disputes

In particularly complex cases, courts often find themselves without the specialized knowledge or expertise required to thoroughly evaluate intricate technical or financial facts. Referees play a crucial role in filling this important gap by offering expert, impartial insights and assessments that contribute significantly to ensuring fair and just outcomes.

Their involvement not only supports the judicial process but also promotes greater transparency, enhances overall efficiency, and improves the accuracy of decisions made within the courtroom.

For professionals who are navigating the often complicated world of disputes or contracts, having a clear understanding of the role and function of a referee can be incredibly beneficial. This knowledge can assist in anticipating the ways in which complex issues and disagreements might be resolved effectively.

Additionally, it helps set realistic expectations about the process and outcomes if a referee is appointed to oversee the matter. Understanding these dynamics can lead to better preparation and a more informed approach throughout the dispute resolution or contract management process.

Current Trends and Developments in Guarantors, Sureties, and SME Lending

The landscape of guarantors and sureties in the realm of business finance is undergoing rapid and profound transformation, influenced by a combination of regulatory changes, technological advancements, and evolving market demands.

These emerging trends carry particular importance for small and medium enterprises (SMEs), which frequently depend on guarantors as a critical means to secure credit, especially when they face challenges such as limited collateral or insufficient credit history.

Below are the most important developments that are shaping and will continue to shape this dynamic field throughout the year 2025:

Increased Use of Guarantors in SME Lending

Banks and financial institutions are increasingly demanding personal guarantors for SME loans as a common requirement. This trend is primarily driven by the higher risk profile associated with many small and medium-sized enterprises, which often have limited or insufficient credit histories to satisfy lenders on their own.

Personal guarantees, which are typically provided by company directors or business owners themselves, act as an extra layer of security for the lenders. This additional assurance helps to boost lender confidence significantly, making it more likely that loans will be approved and ultimately repaid in full.

Regulatory focus

The Lending Standards Board (LSB) in the UK has recently introduced significantly stronger and more comprehensive protections specifically designed for guarantors. These new measures require lenders to provide clear, detailed, and easily understandable information regarding the guarantors’ obligations.

Additionally, lenders must now send annual reminders to guarantors, confirming their ongoing liability and ensuring they remain fully aware of their commitments. The primary goal of these enhanced protections is to prevent guarantors from being unexpectedly caught off guard by their financial responsibilities, while also promoting greater transparency and accountability throughout the entire lending process.

Global initiatives

Various programs, such as Hong Kong’s SME Financing Guarantee Scheme, provide essential support by offering government-backed guarantees that cover up to 90% of loan amounts. These initiatives play a crucial role in helping small and medium-sized enterprises (SMEs) gain easier access to much-needed capital, while significantly reducing the financial risk for lenders.

This type of support empowers small and medium-sized enterprises (SMEs) to obtain funding with greater confidence and assurance, thereby significantly facilitating their ability to grow and develop their businesses effectively within highly competitive market environments.

Digital Verification of Guarantors

Technology is completely transforming and revolutionizing the way guarantors are verified and assessed in today’s fast-paced world:

- Faster credit checks and identity verification conducted through advanced digital platforms enable lenders to swiftly and accurately evaluate the creditworthiness of guarantors. This streamlined process significantly reduces the overall loan processing times, making the entire experience more efficient. As a result, borrowers benefit from improved and quicker access to the funds they need, enhancing their ability to secure loans promptly.

- Digital tools also play a crucial role in facilitating the ongoing and continuous monitoring of guarantor liabilities, making it significantly easier for both lenders and guarantors to stay well-informed and up-to-date about any outstanding obligations that need to be addressed. This constant access to real-time information helps ensure transparency and accountability throughout the guarantee arrangement.

This emerging trend significantly enhances lender confidence while simultaneously streamlining and simplifying the borrowing experience for both small and medium-sized enterprises (SMEs) as well as their guarantors.

Legal Reforms Protecting Guarantors

Several jurisdictions around the world are increasingly tightening regulations and implementing stricter rules to better protect guarantors from being subjected to unfair and excessive liabilities:

- Clearer disclosure requirements: Lenders are now required to provide comprehensive and detailed information about the specific nature and full extent of the guarantee. This ensures that guarantors have a thorough understanding of all potential risks and obligations involved before they commit and sign the agreement.

- Encouragement of independent legal advice: Guarantors are strongly encouraged to seek independent legal counsel to fully understand and appreciate the extent of their commitments and obligations. Obtaining professional legal advice helps ensure that they are completely informed about the potential risks and responsibilities involved.

- Annual reminders: As previously mentioned, lenders are obligated to provide guarantors with a reminder every year that their guarantee is still active and in force. This important requirement helps to prevent any surprises for the guarantors and encourages them to communicate early if their circumstances or financial situation change in any way. This proactive approach ensures that both parties remain well-informed and prepared.

These reforms carefully balance the essential need to protect guarantors from undue risk while simultaneously ensuring continued access to vital finance and funding options for small and medium-sized enterprises (SMEs). This approach aims to create a fair and supportive financial environment that benefits both guarantors and businesses seeking financial assistance.

Rise of Surety Bonds and Digital Platforms

In industries such as construction and government contracting, the use of surety bonds is evolving and becoming increasingly sophisticated and complex. These bonds are now designed with more advanced features and tailored to address a wider range of risks and requirements specific to these sectors. This growing sophistication reflects the need for:

- Digital platforms have now made it significantly easier to handle the issuance, management, and claims processing of surety bonds, greatly enhancing overall efficiency and transparency throughout the entire process. These advanced technologies streamline operations, reduce manual errors, and provide real-time access to important bond information, thereby improving the experience for all parties involved.

- These technological innovations significantly reduce administrative burdens and accelerate the process of contract approvals, providing substantial benefits for contractors, project owners, and sureties alike. By streamlining workflows and minimizing paperwork, these advancements make project management more efficient and effective for all parties involved.

The increasing and widespread use of surety bonds reflects their critical importance in guaranteeing performance and ensuring full compliance in a wide range of complex projects. These bonds have become essential tools for managing risks and providing assurance to all parties involved.

Summary of the Current Trends and Developments in Guarantors, Sureties, and SME Lending

| Trend | Description | Impact on SMEs and Guarantors |

|---|---|---|

| Increased Use of Guarantors | More lenders require personal guarantees for SME loans due to higher risk profiles. | Greater access to finance but increased liability risk for guarantors. |

| Digital Verification | Faster credit and identity checks via technology platforms. | Streamlined loan approvals and better monitoring. |

| Legal Reforms | Stronger protections, including disclosure, legal advice, and annual reminders. | Improved guarantor awareness and protection. |

| Rise of Surety Bonds | Digital tools simplify surety bond management in construction and government contracts. | Enhanced efficiency and security in project delivery. |

Why These Developments Matter

For young professionals, entrepreneurs, and SME owners, gaining a thorough understanding of these emerging trends is crucial in today’s dynamic financial landscape. While guarantors continue to play an essential role in unlocking access to credit and financing opportunities, the landscape is shifting due to evolving regulations and advances in technology.

These changes mean that guarantors are now more informed, better protected, and equipped with greater resources than ever before. Nevertheless, the inherent financial risks involved still require careful and thoughtful consideration, as well as seeking professional advice, before making the important decision to act as a guarantor or surety.

Risks and Responsibilities: What You Must Know Before Agreeing to Be a Guarantor or Surety

Taking on the role of a guarantor or surety is far more than just doing a simple favor for someone—it represents a serious legal and financial commitment that can lead to significant and lasting consequences. Before you decide to agree to back someone else’s loan, lease, or contract, it is crucial that you fully understand all the risks, obligations, and responsibilities involved in this type of agreement.

Immediate Liability

One of the most significant and pressing risks involved is the issue of immediate liability. If the borrower or principal party defaults on their payment obligations, you might be required to pay the outstanding debt or fulfill the financial obligation immediately and without delay.

This can happen even before the lender or creditor has made any substantial attempts to collect the debt from the original borrower. Consequently, you could be confronted with sudden and unexpected financial demands that have the potential to severely disrupt your financial stability and planning.

Potential Asset Loss

As a guarantor or surety, your assets could be significantly at risk and potentially subject to claims. This encompasses a wide range of your valuable holdings, including but not limited to your savings accounts, investment portfolios, real estate properties, and any other forms of valuable personal property you may own.

If you fail to fulfill the financial obligations, creditors have the legal right to initiate action to seize these assets to recover the outstanding debt or any associated losses. Due to this considerable exposure, it is crucial to carefully assess and thoroughly evaluate your overall financial capacity and stability before agreeing to take on such a responsibility.

Credit Damage

Your credit score and overall creditworthiness can be significantly and negatively impacted if the borrower fails to make payments on time or defaults on the loan. Any late payments that are reported on the loan or debt you have guaranteed will be reflected on your credit report.

This can result in a lower credit score, which may make it more difficult for you to secure credit or obtain loans in the future, potentially affecting your financial opportunities and stability.

Legal Action

Failure to fulfill your obligations as a guarantor or surety can lead to serious legal consequences, which may include a variety of actions taken against you under the law, such as:

- Lawsuits that have been filed by lenders or creditors seeking repayment or enforcement of financial obligations. These legal actions are initiated when borrowers or debtors fail to meet the terms of their agreements, prompting lenders or creditors to pursue formal litigation to recover owed amounts or to protect their financial interests.

- Court judgments that mandate repayment of debts or obligations. These legal decisions require the losing party to return money or assets to the winning party as determined by the court. The orders are enforceable by law and typically arise from disputes involving loans, contracts, or other financial agreements where one party fails to fulfill their repayment responsibilities.

- Wage garnishments or bank account levies are legal actions taken to satisfy outstanding debts owed by an individual. These measures involve the direct deduction of money from a person’s paycheck or the freezing and withdrawal of funds from their bank account to repay creditors. Such enforcement tools are commonly used by creditors to ensure that debts are paid when other collection efforts have been unsuccessful.

Legal proceedings often prove to be incredibly time-consuming, expensive, and emotionally stressful, which only serves to further exacerbate and intensify the overall financial burden and impact involved.

Emotional and Family Impact

Financial strain caused by guarantor or surety obligations can also have a significant impact on your personal relationships and emotional well-being. Disputes over money, ongoing stress from financial pressures, and potential conflicts with family members or close friends who are involved can take a serious toll on your mental health, overall happiness, and social life.

These challenges may lead to feelings of anxiety, resentment, and isolation, further complicating your ability to maintain healthy and supportive relationships.

Pro Tips Before You Sign

- Read the Agreement Thoroughly: Take the time to carefully read and fully understand every single clause within the agreement, paying special attention to those sections that outline your liability limits and the specific conditions under which you are required to make payments. It is essential to grasp all the details to avoid any unexpected obligations or misunderstandings.

- Know Your Limits: It is essential to clearly define whether your liability is limited or unlimited, whether it applies partially or fully, and specify the exact duration for which this liability is valid. Being precise about these limits helps prevent misunderstandings and ensures all parties are aware of their responsibilities over a defined period.

- Seek Legal Advice: It is highly recommended that you consult with a qualified lawyer or a trusted financial advisor who can provide you with expert guidance. Doing so will help ensure that you fully understand the potential risks involved as well as the protections and safeguards available to you throughout the process.

- Assess Your Financial Capacity: Before agreeing, carefully evaluate whether you can realistically manage and cover the financial obligation without putting your overall financial stability or well-being at risk. It is crucial to ensure that taking on this responsibility will not cause undue stress or jeopardize your ability to meet other essential expenses and commitments.

- Communicate Openly: Take the time to have a thorough and honest discussion with the borrower about the arrangement. Make sure that both parties fully understand and agree on a clear, detailed plan for repayment. Additionally, establish a reliable method for ongoing communication to address any potential difficulties or changes that might arise during the repayment period, ensuring transparency and trust throughout the process.

Being a guarantor or surety is often seen as a generous and supportive gesture, demonstrating trust and willingness to help someone in need. However, this role carries significant risks that should never be taken lightly or underestimated.

It is crucial to approach this commitment with a high degree of caution, thorough knowledge, and, whenever possible, professional guidance. By doing so, you can protect yourself from potential unexpected financial difficulties and make well-informed decisions that help safeguard your financial future and peace of mind.

FAQs

Can a guarantor limit their liability?

Guarantors can negotiate limited liability, which means they may only be responsible for a portion of the debt or a specific period. The extent of liability depends on the terms outlined in the guarantee contract. Always ensure these limits are documented before signing.

What is the difference between a guarantor and a co-signer?

A co-signer shares equal responsibility for the loan from the outset and usually has rights to the asset purchased with the loan (such as a car or home). A guarantor, on the other hand, only becomes responsible if the borrower defaults and typically does not have any claim to the asset.

Can a guarantor withdraw from their obligation?

Withdrawing from a guarantee after signing is generally difficult. Some jurisdictions allow withdrawal if the lender consents or if the borrower fully repays the loan. It’s important to review the contract terms and seek legal advice if you want to explore withdrawal options.

What happens if a guarantor dies?

If a guarantor passes away, their estate may still be liable for any outstanding debts covered by the guarantee. This liability depends on local laws and the terms of the agreement. Estate planning and legal consultation can help manage these risks.

How is a referee appointed in legal cases?

Courts appoint referees either by mutual agreement of the parties involved or through formal court orders. Referees are tasked with investigating specific issues in a dispute and reporting their findings to assist the court in making informed decisions.

In Conclusion

Being a guarantor or surety can be a meaningful way to support a friend, family member, or business partner. However, it is important to recognize that these roles come with significant risk and responsibility. Unlike a referee, whose role is strictly investigative and advisory, guarantors and sureties face potential financial liability that can affect their credit scores, personal assets, and legal standing.

Before agreeing to take on these commitments, it is essential to carefully consider and thoroughly evaluate all aspects involved:

- Fully understand your obligations and the extent of your liability.

- Assess your financial ability to cover the debt or fulfill the contractual obligation if the primary party defaults.

- Seek professional legal and financial advice to clarify risks and protections.

- Consider the long-term impact on your creditworthiness and family relationships.

By approaching these roles with caution, clarity, and knowledge, you can protect yourself from unexpected financial burdens and make decisions that align with your career ambitions and personal well-being.

Remember: “Read before you sign” is much more than just a common saying—it is an essential principle that plays a crucial role in protecting and safeguarding your financial future from potential risks and unexpected obligations.

Discover more from BizTechNomy

Subscribe to get the latest posts sent to your email.